Beware of Money App Scams!

February 18, 2022

Beware of Money App Scams!

As we are building our economic legacy, it's important to ensure that we are also PROTECTING it as well. This article focuses on ensuring the safety of your financial transactions by making you aware of the many ways consumers are victimized and scammed out of our hard-earned money.

The growing use of what are referred to as peer to peer (P2P) mobile payment services such as cashapp, venmo, zelle and paypal, presents us with new threats to our financial well-being as there are always unscrupulous individuals waiting to take advantage of novice users.

Below are a few of the more popular apps that are convenient ways to send fast cash to friends or pay for services. Though scammers have many different ways of taking your money, Please take heed of some the common scams associated with them.

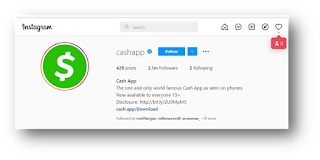

Cashapp does not have live support! Problems and issues with your account are handled via contact with cashapp within the app itself. There are websites out there created by scammers pretending to be cashapp support. Any calls, texts, emails, or social media contacts you receive claiming to be someone from cashapp should be avoided. Do not download any screensharing apps from anyone claiming to be cashapp customer service.

Fake Cashapp Friday Offers

There is a real #CashappFriday sweepstakes where you can win cash prizes, however there are 10 times as many fake cashapp give-away sites on social media. If you choose to enter this sweepstakes, be sure to check the link or social media account to make sure it comes from a verified cashapp twitter or instagram account. Look for a blue checkmark next to the username.

There is a real #CashappFriday sweepstakes where you can win cash prizes, however there are 10 times as many fake cashapp give-away sites on social media. If you choose to enter this sweepstakes, be sure to check the link or social media account to make sure it comes from a verified cashapp twitter or instagram account. Look for a blue checkmark next to the username.

You get an email or text claiming you have received funds via PayPal OR that there have been unrecognized transactions on your account. The text/email includes a link that is supposed to take you to your account page to login to confirm the transfer or verify the transactions. In actuality, the link takes you to a fake PayPal login page where you enter your credentials and unknowingly give your login information to fraudsters who then steal your money or use your account to purchase items.

If you sell items online beware of overpayment and shipping address scams. With overpayment scams someone will purchase an item from you but "accidentally" overpay for the item. They then ask you to pay them the difference back directly. After you've given them back the overpayment, they file a hacking claim with PayPal saying they didn't intend to pay you that amount. They get all of their money back but you are out of the overpayment amount you paid them.

With shipping scams an item is purchased from you but you are given a fake address to send the item to. Since the item can't be delivered to the fake address the shipper marks it as undeliverable. The scammer then contacts the shipping company and gives them a new address to send the item to. Once they receive it, they file a claim with PayPal saying they never got their item since the only address on file with PayPal will be the invalid one. The scammer gets refunded the full amount, but you lose the payment for the item.

You receive a text or a call from someone claiming to be from the bank's fraud department asking if you have made a payment of some amount to an unknown person using Zelle. You of course say no and they then proceed to "verify your identity" by asking you for your username and then asking you to read back the code that was sent to you via text message. An unsuspecting consumer may follow this direction because they are so concerned with the potential threat on their account that they do not read the message that comes with the confirmation text which says specifically to not share the code with anyone.

In reality, the scammer is resetting your password and gaining access to your account. They then tell you they will "put you on hold" while they verify your account, but instead they are stalling you while they quickly use the Zelle feature to send money from your account to some untraceable Zelle user.

Protecting Yourself From Scammers

- Instead of following unsolicited links that were sent to you to sign into your account, type in the web address for your banking institution directly and then login normally.

- Hang-up, Look Up, Call Back! If an unsolicited caller claims to be from your bank, or if you are in doubt about who the caller is, ask for their office extension and tell them you will call them back at the bank phone number provided on the back of your debit card. If they give you a number different from what is on your card to call, google the number to see if any corroborating information can be found to verify it's legitimacy.

- Understand that scammers can "spoof" a bank's phone number and make it look like the call is coming from your bank. This immediately puts most consumers off guard making them more likely to believe they are speaking with a bank employee.

- Understand that there is a difference between fraud and scams. While most banks have remedies for fraud which is the unauthorized access to someone account, there may be different or no remedy for when the consumer unknowingly gives a scammer their personal or banking information.

Mu Upsilon Omega Chapter

Target III Committee

Telisha Martin, Chair

Shelby Lucas, Co-Chair

Judith Alford-Lightsey

Mechelle Caldwell

Cynthia Cooper

Sandra Cummings

Dale George-Harris

Debbra Livingston

Dorothy McKinzie

Faye McKnight

Sarah Richardson